The Obama administration has included a carried-interest tax increase in each of its annual federal budgets and even more recently in the American Jobs Act introduced last September, where the current law on carried interests was described as “an unfair and inefficient tax preference.”

Changes in tax policy and treatment is worth examining and a good place to start is asking Romney what he thinks.

Certain hedge fund managers, real estate investors and venture capitalists earn much of their pay in the form of carried interest. Leon Cooperman, a prominent hedge fund manager, recently called the special treatment “ridiculous.” The White House, which has long expressed support for raising the tax rate on these investment managers and Democratic lawmakers have introduced tax-reform legislation amid a populist backlash against the extraordinary wealth being created on Wall Street. The effort died in Congress after an aggressive lobbying effort from private equity and hedge fund firms.

The bulk of private equity executives’ compensation comes in the form of carried interest, which is the 20 percent cut of a fund’s profits they keep for themselves. If a private equity firm sells a company for a $1 billion profit, the firm’s executives are entitled to keep $200 million as a performance fee. (Mr. Romney’s former firm, Bain Capital, because of its superior investment record, keeps 30 percent of the profits in many of its funds.)

Most private-equity funds are organized as limited partnerships with the investors (pension funds, endowments, foundations and wealthy individuals) contributing capital and becoming limited partners with a general partner — such as Bain Capital — that provides the entrepreneurial management of the partnership. The general partner is paid a management fee.

The general partner may also contribute its own capital and, as an incentive, receives an additional interest in the overall eventual profits. This additional interest is known as the “promote,” “profits interest,” or “carried interest.” The carried interest is typically 20% of the profits and is generated from appreciation in the value of the partnership’s property realized when the enterprise is sold or taken public.

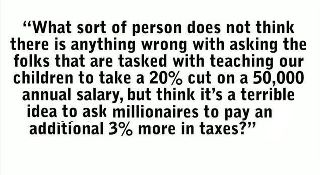

The tax treatment of carried interest under current law allows managers of hedge funds, private-equity funds, venture-capital funds and others to pay a lower 15% maximum income tax rate applied to investment income as capital gains, rather than higher income tax rates for ordinary income which exceed 35%. This is a huge difference.

No comments:

Post a Comment